Hsa Limits 2025 Married Filing Separately

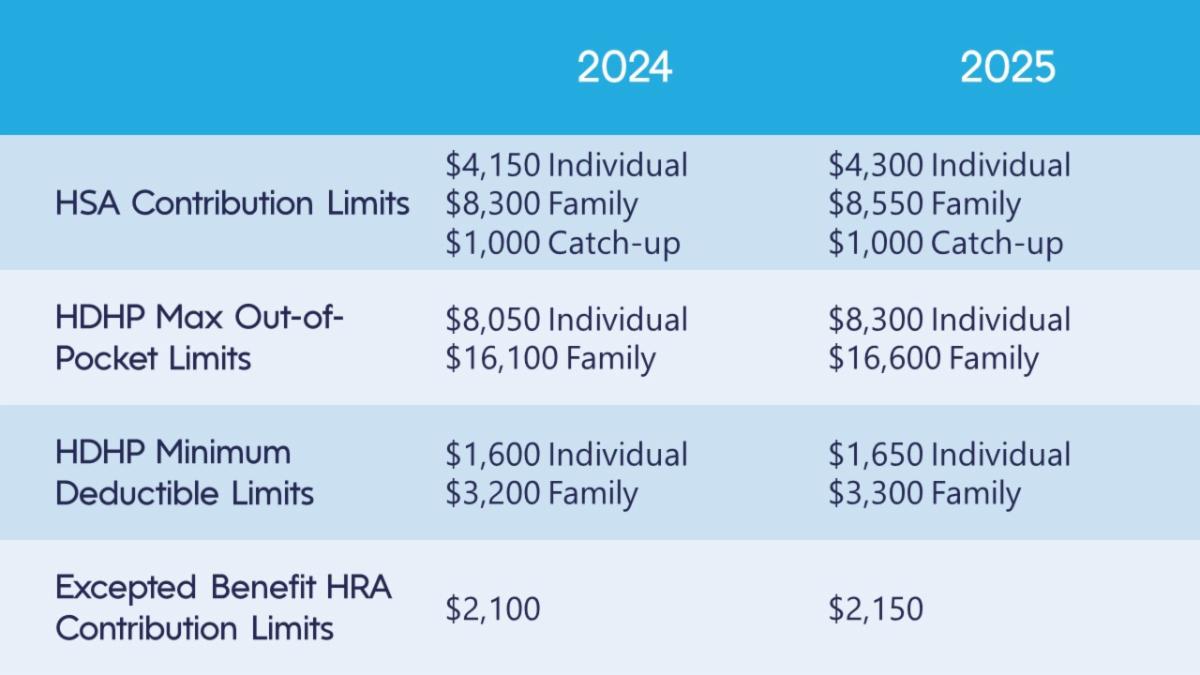

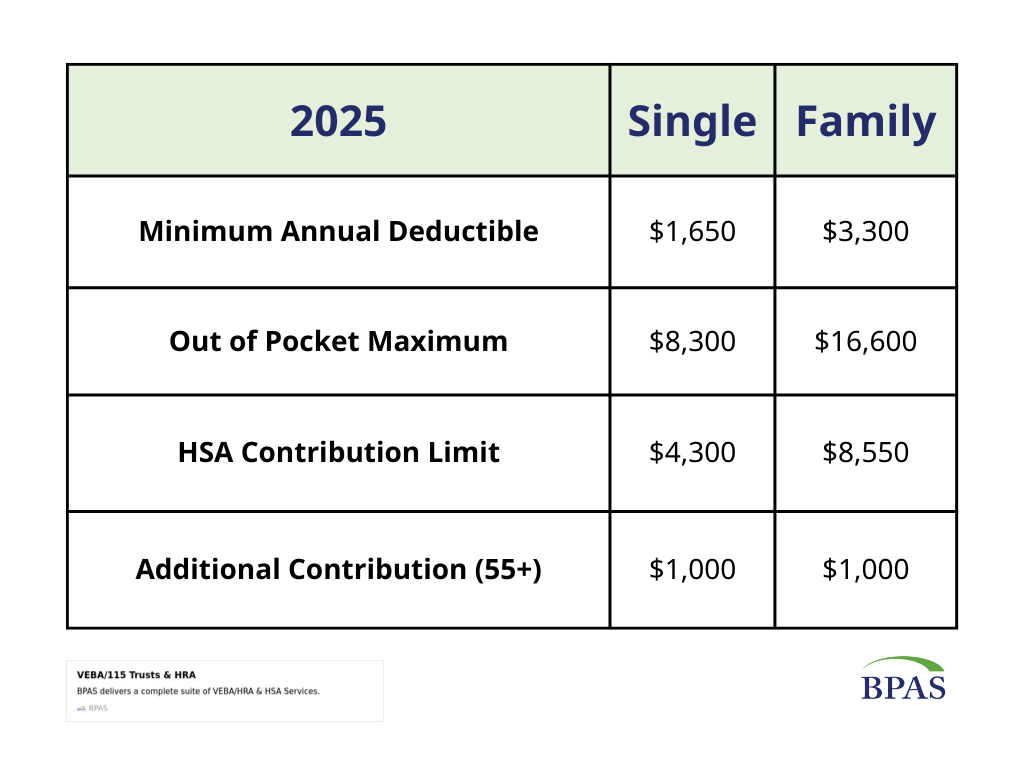

Hsa Limits 2025 Married Filing Separately. $8,550 (up $250 from 2025); Single taxpayers and married couples filing separately:

In addition, the social security taxable wage base, which affects qualified retirement plans integrated with. The following benefit limits apply for 2025:

Hsa Limits 2025 Married Filing Separately Images References :

Source: chloepeake.pages.dev

Source: chloepeake.pages.dev

Hsa Max 2025 Married Spouse Chloe Peake, These limits restrict the contributions that can be made to, and benefits.

Source: rodabmalorie.pages.dev

Source: rodabmalorie.pages.dev

Hsa Contribution Limits 2025 Married Jointly Emili Elsbeth, For dependent care accounts (dca), annual limits will remain $5,000 for single taxpayers and married couples filing jointly, or $2,500 for married people filing separately.

Source: www.bpas.com

Source: www.bpas.com

Updated HSA Contribution Limits for 2025 BPAS, Single taxpayers and married couples filing separately:

Source: www.firstdollar.com

Source: www.firstdollar.com

IRS Announces Increases to HSA Contribution Limits and More for 2025, Singles and married individuals filing separately:

Source: lisbethwerinna.pages.dev

Source: lisbethwerinna.pages.dev

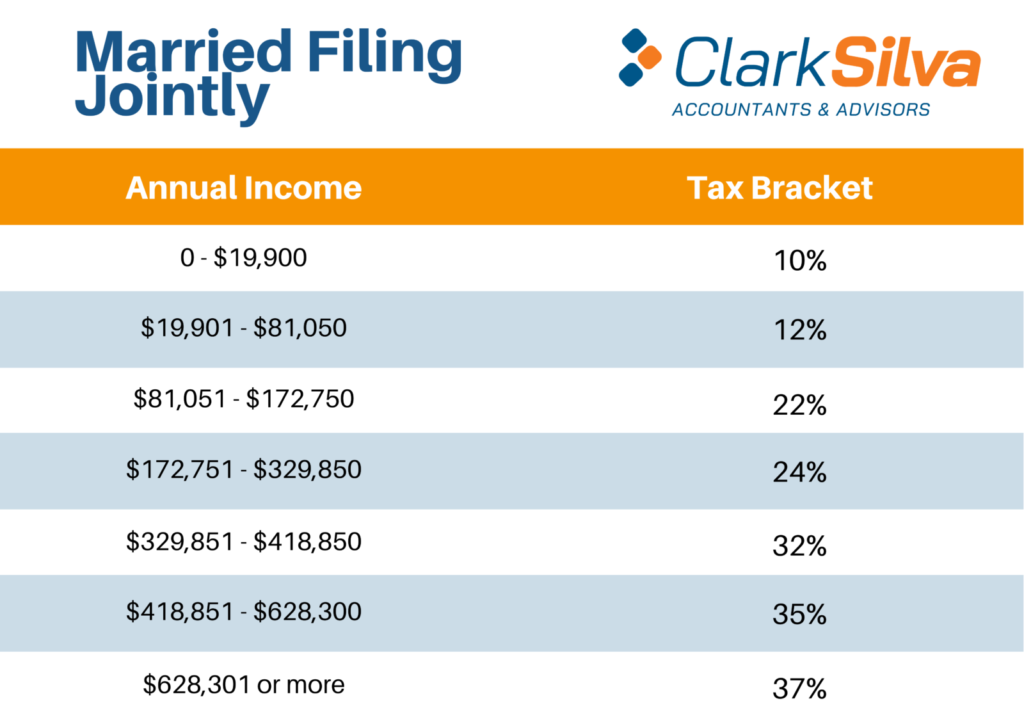

Hsa Contribution Limits 2025 Married Filing Jointly Brandi Estrella, Your tax rate will be higher.

Source: inahjkyasmeen.pages.dev

Source: inahjkyasmeen.pages.dev

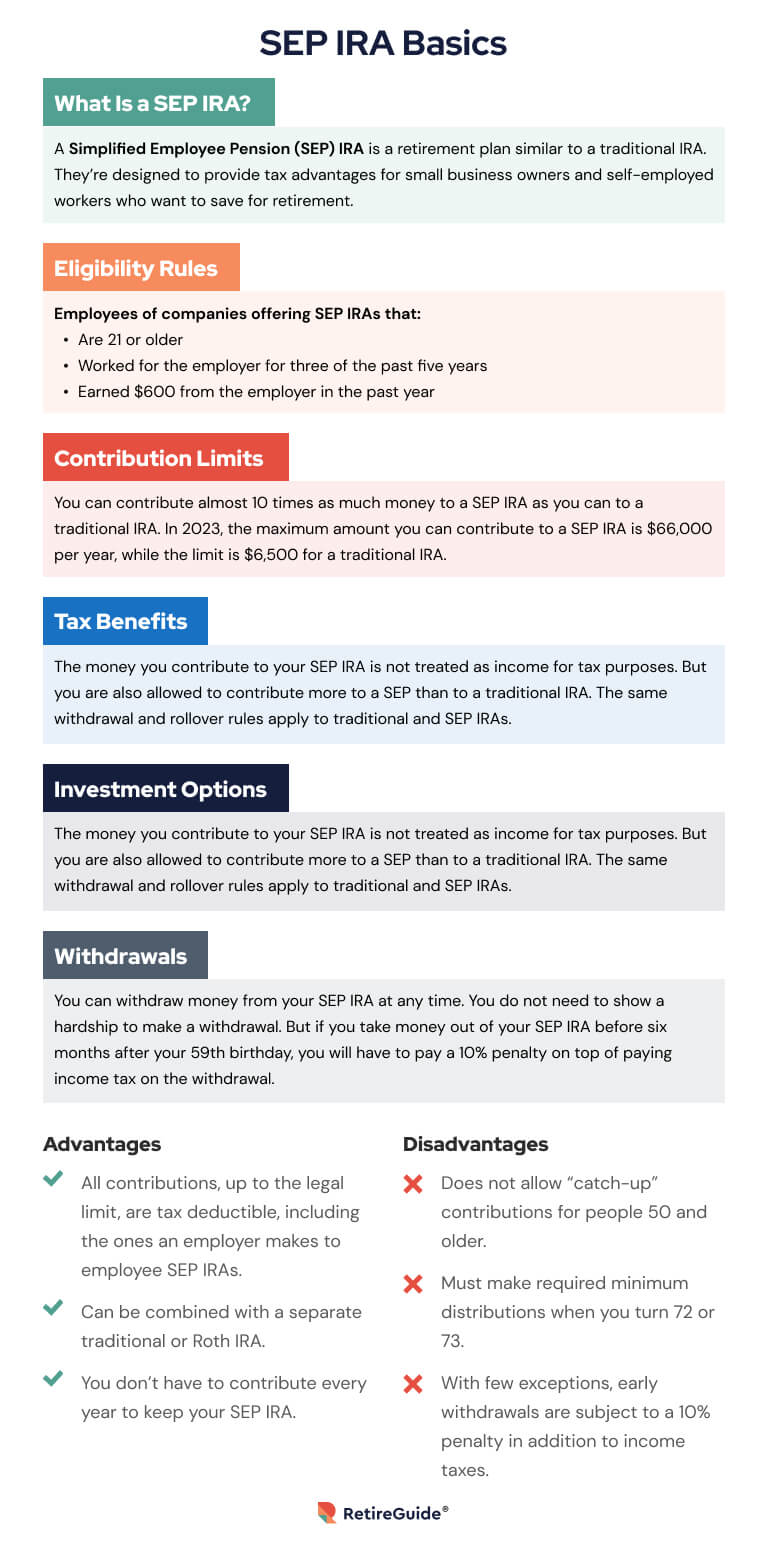

2025 Sep Ira Contribution Limits For Married Couples Sonny Elianora, Single taxpayers and married couples filing separately:

Source: sayrevchiarra.pages.dev

Source: sayrevchiarra.pages.dev

Max 401k Contribution Married Filing Jointly 2025 Dana Milena, The children will both be on her healthcare plan.

Source: dyannahjkgretchen.pages.dev

Source: dyannahjkgretchen.pages.dev

2025 Ira Contribution Limits 2025 Limits For Married Couples Aubry, These limits restrict the contributions that can be made to, and benefits.

Source: inahjkyasmeen.pages.dev

Source: inahjkyasmeen.pages.dev

2025 Sep Ira Contribution Limits For Married Couples Sonny Elianora, Hsa contribution limits for 2025.

Source: inahjkyasmeen.pages.dev

Source: inahjkyasmeen.pages.dev

2025 Sep Ira Contribution Limits For Married Couples Sonny Elianora, $8,550 (up $250 from 2025);

Category: 2025